iowa capital gains tax rate 2021

The Combined Rate accounts for Federal State and Local tax rates on capital gains income the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations which results in a tax rate increase of 118 percent. Start filing your tax return now.

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Should the Department request it the information on the Capital Gain Deduction Checklist will be needed to verify whether you qualify for the deduction.

. In 2021 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a. Elimination of retirement income tax. The rate jumps to 15 percent on capital gains if their income is 40401 to 445850.

The new tax law will reduce individual and corporate income tax rates provide exemptions from Iowa tax for certain forms of retirement income--including retired farmer rental income--and scale back certain tax credits. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. If your Iowa taxable income is over.

On March 1 2022 Governor Kim Reynolds signed HF 2317 into law. Before the official 2022 Iowa income tax rates are released provisional 2022 tax rates are based on Iowas 2021 income tax brackets. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains.

Iowa Cigarette Tax. These changes have different effective dates but most. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20.

2021 federal capital gains tax rates. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to pay will generally be lower as the state allows a deduction for federal income tax. The 2018 tax reform legislation set the top individual tax rate for 2023 and beyond at 65 percent.

The tables below show marginal tax rates. The law modifies Iowa. 2021 Iowa Income Tax Brackets and Rates for All Filing Statuses.

Rounded to the nearest whole percent this average is 40 percent. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. The top rate will lower to 6 giving a tax cut to Iowans making 75000 or more.

These numbers rose slightly for the year 2021. Starting in 2023 Iowa Code 422721 would be amended to narrow this deduction to the net capital gain from the sale of real property used in a farming business if certain conditions are satisfied. Theres never been a better time in Iowa for bold sustainable tax reform that meets the priorities of the state allows Iowans to keep more of what they earn and creates a highly competitive tax system.

39 individual income tax rate. Iowa has a cigarette tax of 136 per pack. Iowa collects a state corporate income tax at a maximum marginal tax rate of 12000 spread.

The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Individuals earning between 40001 to 441450 and married couples filing jointly making 80001 to 496600 face a 15 capital gains tax. See Tax Case Study.

Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years. Provisional 2022 tax rates are based on Iowas 2021 income tax. Current Iowa law has complex rules governing the deductibility of certain capital gains.

The package includes a corporate tax cut. Detailed Iowa state income tax rates and brackets are available on this page. The top rate will lower to 57 giving a tax cut to Iowans making.

Exemption of net capital gains on sale of employee-awarded capital stock. Short-term gains are taxed as ordinary income. Short-term capital gains come from assets held for under a year.

Anyone earning beyond 441450 and for married couples 496600 face a capital gains tax rate. On the next page you will be able to add more details like itemized deductions tax credits capital gains and more. Heres how the rates will change.

Iowa allows taxpayers to deduct federal income taxes from their state taxable income. Iowa tax forms are sourced from the Iowa income tax forms page and are updated on a yearly basis. For example a single.

Iowa Capital Gains Tax. The 2021 state personal income tax brackets are updated from the Iowa and Tax Foundation data. You must complete the applicable IA 100 form to make a claim to the Iowa capital gain deduction on your return.

Both long- and short-term capital gains are taxed at the full Iowa income tax rates depending on your income tax bracket. Iowa tax law follows the federal guidelines on the exclusion of gain on the sale of a principal residence. What is the iowa capital gains tax rate 2020 2021.

Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. Individual income tax exclusion for capital gains narrowed. This means that different portions of your taxable income may be taxed at different rates.

Iowa Capital Gains Tax. Excise taxes on alcohol in Iowa vary depending on the type of alcohol being sold. Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022.

Enter 100 of any capital gain or loss as reported on federal form 1040 line 7. When a landowner dies the basis is automatically reset to the current fair market value at the time of death. Your income and filing status make your capital gains tax rate on real estate 15.

A copy of your federal Schedule D and federal form 8949 if applicable must be included with this return if required for federal purposes. The current statutes rules and regulations are legally controlling. Before the official 2021 Iowa income tax rates are released provisional 2021 tax rates are based on Iowas 2020 income tax brackets.

2021 federal capital gains tax rates. A Like-Kind Exchange with a conservation agency might help you protect land while deferring.

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

State Corporate Income Tax Rates And Brackets Tax Foundation

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Capital Gains Tax Rates By State Nas Investment Solutions

Iowa Reduces Corporate Individual Income Tax Rates Grant Thornton

How Is Tax Liability Calculated Common Tax Questions Answered

Income Tax Brackets For 2022 Are Set

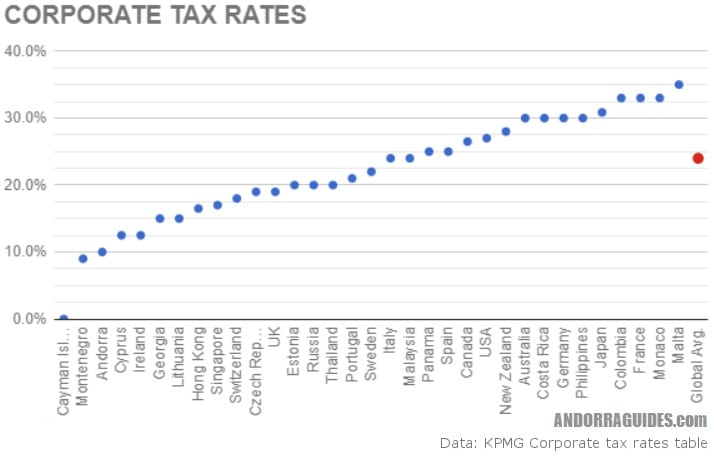

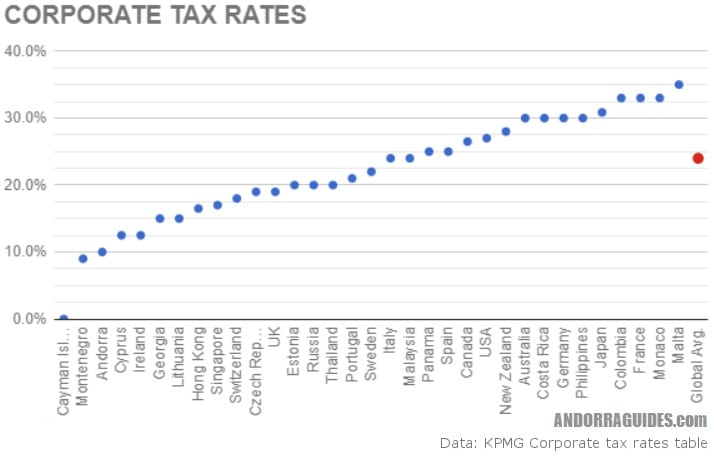

The Andorra Tax System Andorra Guides

The States With The Highest Capital Gains Tax Rates The Motley Fool

Pin By The Taxtalk On Income Tax Dividend Income Tax Taxact

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

2021 Capital Gains Tax Rates By State

How Is Tax Liability Calculated Common Tax Questions Answered

Dividend Tax 2021 22 Explained Raisin Uk

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com